In an era where financial advice is often complex and overwhelming, the principle of Financial Simplexity offers a refreshing and straightforward approach: live within your means.

This seemingly simple advice is a powerful tool for achieving financial stability and freedom, applicable to individuals at all income levels.

The Simplexity Approach

Living within your means is fundamental for achieving long-term financial stability and peace of mind. It involves spending less than you earn, allowing you to save and invest, which in turn leads to building wealth over time.

This practice also helps in avoiding the stress and constraints associated with debt. (People suffer sleepless nights about their finances, don't underestimate this) By aligning spending habits with personal financial capabilities, individuals can enjoy a more balanced, secure lifestyle, and are better prepared for unexpected financial challenges.

“For everyone able to play with money, thousands more are locked in a self destructive refusal to use money creatively and strategically.” - Robert Greene

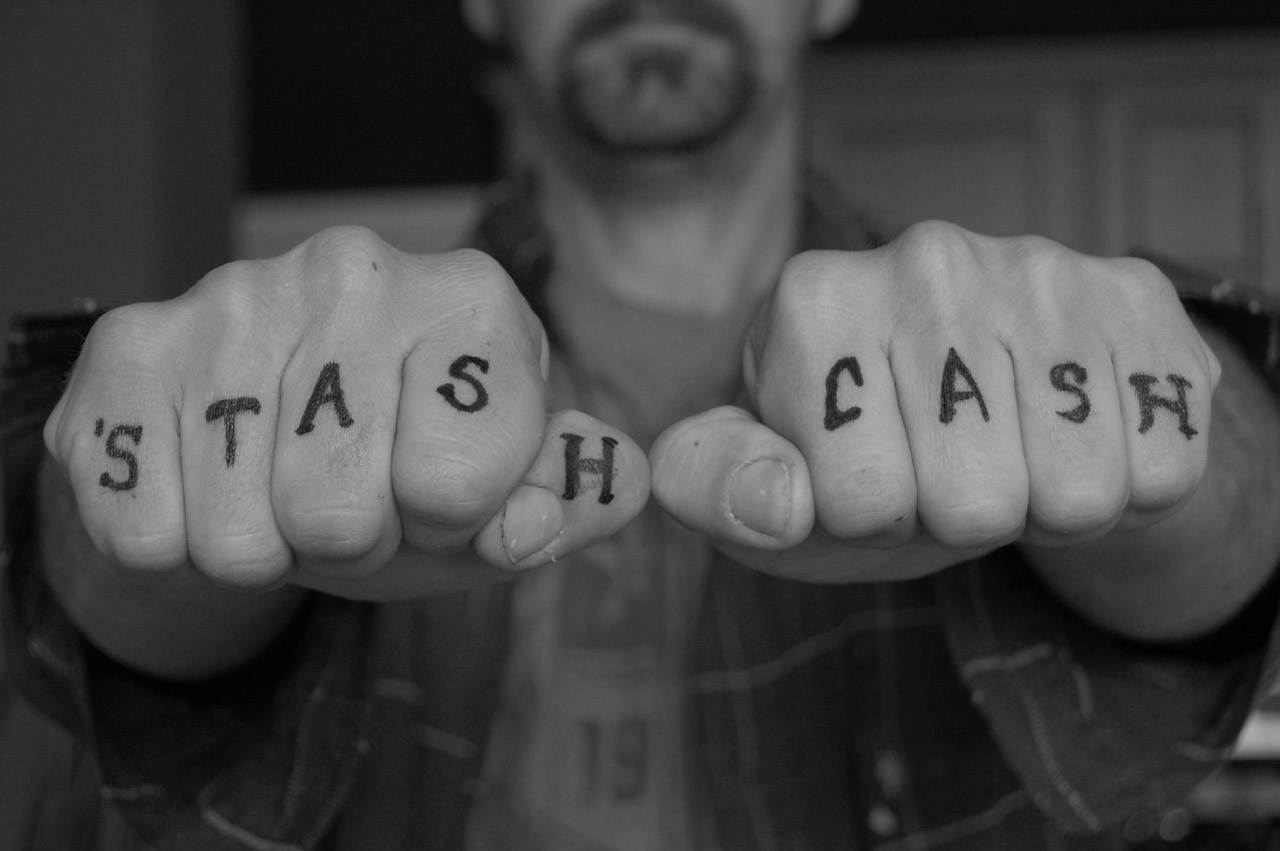

I love this quote from Robert Greene as a daily reminder to use money creatively and strategically - NOT on useless physical or digital possessions.

The Challenges of Simplexity

Adhering to a budget and living within one's means can be challenging in today's society, primarily due to factors like lifestyle creep, social comparisons, and managing major expenses.

Lifestyle Creep: As income increases, so does spending, often subtly. This gradual increase in lifestyle costs can significantly derail financial goals.

Social Comparisons: The influence of social media often creates unrealistic expectations for personal spending, leading to unnecessary expenditures to match perceived societal standards.

The Big 3 - Rent, Travel, Food: These major expenses are common areas of overspending. Careful planning and prioritization are required to manage these costs effectively as they can easily spiral out of control. (For example, the average monthly car payment in the UK is £350 and in the US it's $726. MADNESS)

Depending on your income level, HUGE sacrifices might have to be made here. Remember, peace of mind and security is better than 'keeping up with the Jone's'.

Lessons from "The Richest Man in Babylon"

One of the foundational texts that echo the principles of Financial Simplexity is "The Richest Man in Babylon." This classic book, written by George S. Clason, offers invaluable advice on managing personal finances.

One of its most significant lessons is the importance of saving at least 10% of your income. This simple act of saving a small portion of your earnings can lead to substantial wealth over time, demonstrating that financial security is not solely dependent on how much you earn, but rather how much you save.

Saving is a habit and it’s nice to cultivate that habit as soon as you can. You’ll see a bunch of ‘out of touch’ savings videos on YouTube (how I saved 10,000 in a year, how I paid 200k student debt in 12 months) - but for the ’average Joe’, no matter what you earn, this is a nice starting point.

Lessons from Mr.Money Moustache

Mr. Money Mustache, a popular figure in the personal finance sphere, emphasises the value of frugality and living well below one's means to achieve early financial independence.

His lessons revolve around aggressive saving, wise investing, and lifestyle simplification. (This is not a T3B investment/ how to grow your money post), but by focusing on reducing unnecessary expenses and valuing long-term financial well-being over immediate gratification, Mr. Money Moustache provides a blueprint for achieving financial freedom much earlier than traditional retirement age.

The average savings rate is 6%. Move this to 64% and you can retire in 10 years. - Mr.Money Moustache

He was an early advocate of the FIRE lifestyle (Financially Independent, Retire Early) and his site has a wealth of information I would encourage you to read. If you're stuck, start here:

Lessons from Dave Ramsay

Debt is one of the biggest obstacles to financial freedom. High-interest debt, particularly from credit cards or loans for non-essential items, can quickly become a financial burden.

If you're already heavily in debt, I'd highly recommend the debt snowball method from Dave Ramsay. He also has an amazing 7-step program for building wealth; The 7 Baby Steps. It's a clear and easy process to follow if you have the discipline and are serious about change.

The Importance of Disposable Income

Disposable income - the money left after all essential expenses are paid - is a critical component of Financial Simplexity. This is the money that can be used for savings, investments, or spending on meaningful experiences.

The key is to use this portion of your income wisely, balancing immediate enjoyment with long-term financial goals. Financial Simplexity encourages investing in experiences over material possessions, as experiences tend to provide longer-lasting satisfaction and happiness.

Alongside this, here is a nice guide from ALUX about where to spend your money. It's all mentioned here, but don't skimp on; health, education and your loved ones.

Conclusion

Financial Simplexity is more than just a financial strategy; it's a mindset. Living within your means is not easy for anyone at any income level. As mentioned, lifestyle creep is a real thing that can catch anyone out. It encourages a balanced approach to personal finance, combining wise spending, consistent saving, and thoughtful decision making throughout life.

By embracing the principles of Financial Simplexity, you can navigate the complexities of personal finance with confidence and ease, setting the stage for a secure and fulfilling financial future.

Good luck and thanks for reading.

T3B

Disclaimer

The content provided on this blog, including all text, images, and other material, is for informational purposes only and does not constitute professional advice. The information related to finance and health, as well as other topics, reflects my personal opinions and experiences, and is not intended as a substitute for professional consultation.

While I strive to provide accurate and up-to-date information, I am not a certified financial advisor or a healthcare professional. Therefore, any actions taken based on the content of this blog are at the reader's own risk. I encourage readers to seek professional advice before making any significant decisions related to finance, health, or any other topics covered in this blog.

Please remember that the views expressed on this blog are mine alone and do not reflect the opinions of any professional organizations or affiliations I may have.